unfiled tax returns for deceased

With your unfiled tax returns you could fall into one or more of these situations. Final tax returns must be filed for deceased persons as well.

Income General Information Department Of Taxation

Estate Tax Returns.

. Youll also need that form if the estates gross. Estate tax is a tax on the transfer of assets from the. Not all income is taxable.

A copy of your notices especially the most recent notices on the unfiled tax years. After my mothers recent death it was discovered she had not filed a personal income tax return for 10 years. Heres who should sign the return.

The personal representative of an estate is an executor administrator or anyone else in charge of the decedents property. Bring these six items to your appointment. School University of Windsor.

Among the first tasks an Executor should do is to verify if the decedent was up to date on his individual income tax. That means filing both state and federal taxes for the year of death. She had the mistaken belief that one.

Unfiled returns for deceased taxpayer the later of. Statute of Limitations for Collections and Audits. US Expatriates Chapter 7 bankruptcy lack of records or filing for the deceased may all play a role.

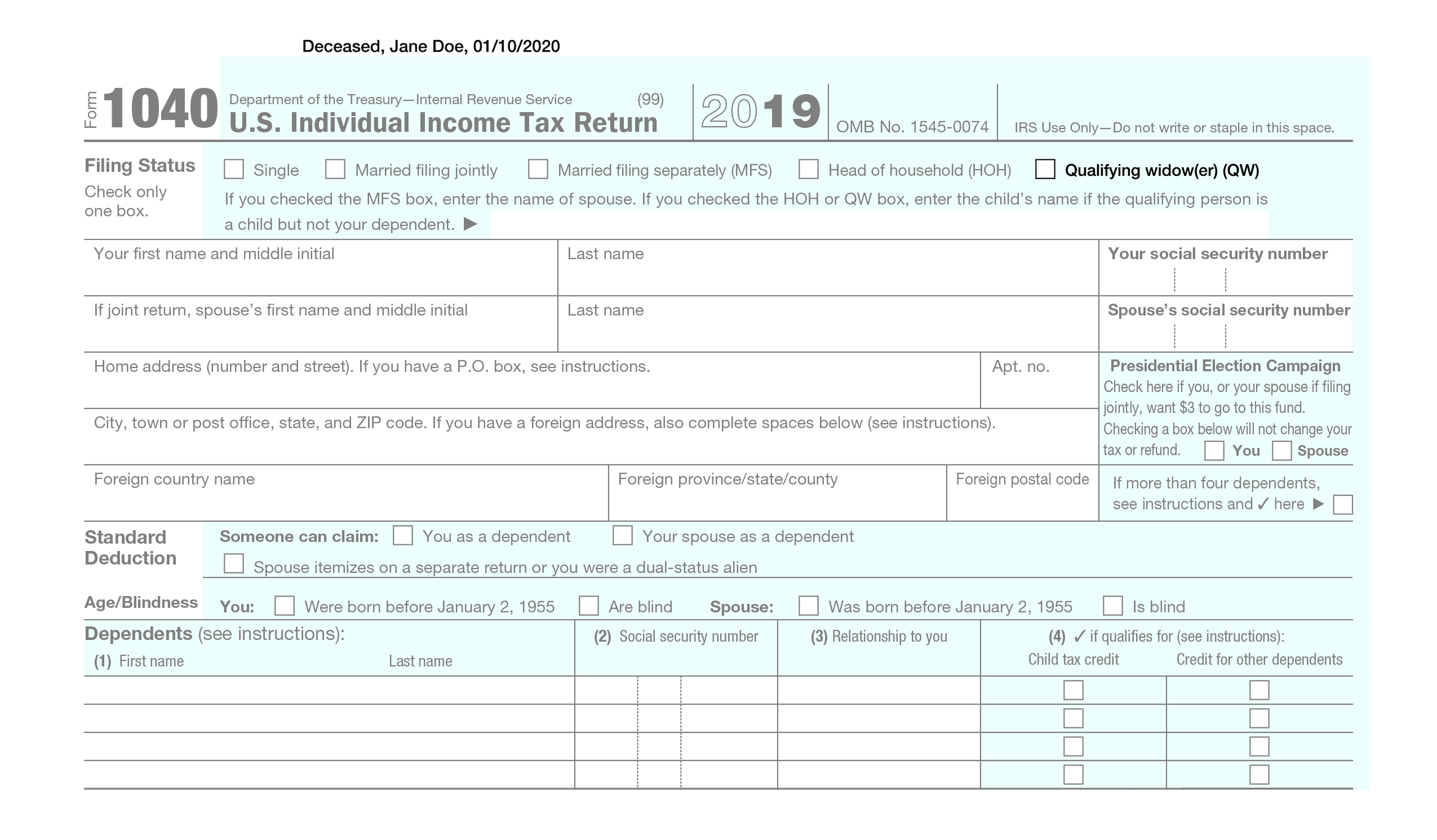

Unfiled tax return for deceased mother. If a deceased person owes taxes in any years prior to his or her death the IRS may pursue the collection of these taxes from the. In most cases the estate representative will need to file an IRS Form 1040.

Unfiled tax return for deceased mother Another questions is was she required to file tax returns. Pages 28 Ratings 80 5 4 out of 5 people. For paper returns the filer should write the word deceased the deceased persons name and the date of death across the top.

The deadline to file these returns is the normal filing deadline of April 30 th or six months after the date of death whichever is later. Income Tax Return for Estates and Trusts. You have until April 15th of the following year to file a tax return.

Late Returns Unfiled Taxes James Abbott CPA from. If the deceased leaves an estate or an inheritance to his family it can be seized to satisfy the outstanding tax liability. If you know you cant file in.

If the deceased person is leaving a taxable estate you must file Form 1041. An Executors job is overwhelming with many responsibilities. Course Title ACCOUNTING MISC.

For example you must file your return for the 2016 tax year by April 15th of 2017. File an estate tax return on Form 706 United States Estate and Generation-Skipping Transfer Tax Return. If you dont file taxes for the decedent and the estate promptly the IRS can file a federal tax lien requiring you pay the decedents income tax ahead of other bills.

Any information statements Forms W-2 1099 that you may. You should probably sit down with an accountant or tax. When filing taxes for a deceased.

If the deceased leaves an estate or an inheritance to his family it can be seized to satisfy the outstanding tax liability. Late Returns Unfiled Taxes James Abbott CPA from.

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Irs Notice Letter 12c Understanding Irs Notice Cp 12c Missing Signature On A Tax Return

The Ultimate Guide To Unfiled Tax Returns Save Time Money And Stress

Steps To Filing Final Tax Return Marcia L Campbell Cpa

Complete List Of Irs Notices Boxelder Consulting

4 19 13 General Case Development And Resolution Internal Revenue Service

Orange County Tax Debt Attorney

Tax Trusts Estates Law Tax Law Cole Schotz P C

What Happens If You Don T File Your Taxes Good Financial Cents

Filing Your Deceased Loved One S Last Tax Return

How To File A Deceased Person S Tax Return

Tax Help Irs Form 56 Irs Tax Advocate

Filing Your Deceased Loved One S Last Tax Return

Tax Fraud Lawyer Hanover Md Crepeau Mourges

Irs Contact Phone Numbers How To Speak To A Live Person

Tax Returns Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How To File Federal Income Tax For A Deceased Person Help When Someone Dies Tusk